does mississippi pay state taxes

By the final year the. How to Make a Credit Card Payment.

/cloudfront-us-east-1.images.arcpublishing.com/gray/NBECF33QPZGYFHMT26IWYT363M.jpg)

Mississippi House Passes Tax Reform Proposal That Includes Phasing Out State Income Taxes

Jan 10 2022 State Resource Answer Mississippi State Payroll Taxes What are my state payroll tax obligations.

. The personal income tax which has a top rate of. FAQs for Individual Income Tax General Information Technical Bulletins E-File Information Tax Forms Mailing. Mississippi collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Mississippi Sales and Use Taxes Sales Tax All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax 7 unless the law exempts the. If someone makes less than 5000 they pay a minimum. Individual Income Tax FAQs.

Mississippis income tax ranges between 3 and 5. State-Specific Information Mississippi is an excellent state for tax lien due to its favorable interest rate of 18 per year and the fact that it is not well-known which limits. You can use this service to quickly and securely pay your Mississippi taxes using a credit card debit card or.

This website provides information about the various. The State Sales Use tax rate in Mississippi is 7. The tax rates are as follows.

Mississippi income tax rate. The most significant are its income and sales taxes. 0 on the first 2000 of taxable income 3 on the.

Mississippi exempts all forms of retirement income from taxation including Social Security benefits income from an IRA income from a 401k and any pension income. On top of that. The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi.

The state does not tax Social Security benefits income from public or private pensions or withdrawals from retirement accounts. However certain localities or towns may charge additional local sales tax. Payment Options Other frequently asked questions found here.

Lawmakers said the tax cut would reduce state revenue by 185 million in the first year. The Mississippi income tax accounts for 34 of state revenue. The Mississippi state tax rate is graduated and are the same for individual filers as well as businesses.

The following is intended to provide general information concerning a frequently asked question about taxes administered by the Mississippi Department of. Unlike the Federal Income Tax Mississippis state income tax does not provide. Mississippi has a 900 percent state sales tax rate a maximum local sales tax rate of 100.

Pay by credit card or e-check. The Mississippi state government collects several types of taxes. Mississippi has a 700 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 707 percent.

But since Mississippi does not require retirees to pay state income tax on qualified income the. Franchise Tax All the businesses in Mississippi. There is an additional convenience fee to pay through the msgov portal.

Mississippi is very tax-friendly for retirees. Road and bridge Privilege Taxes are due upon purchase or renewal of license tags payable to the DOR and vary according to weight age class use mileage apportioned and seating capacity. Mississippi requires employers to withhold income taxes from.

Welcome to the online Mississippi Tax QuickPay for Businesses and Individuals. The state uses a simple formula to determine how much someone owes. Mississippi has a combined state and local sales tax rate of 707 percent.

Reeves In State Of The State Raise Teacher Pay Cut Taxes

Historical Mississippi Tax Policy Information Ballotpedia

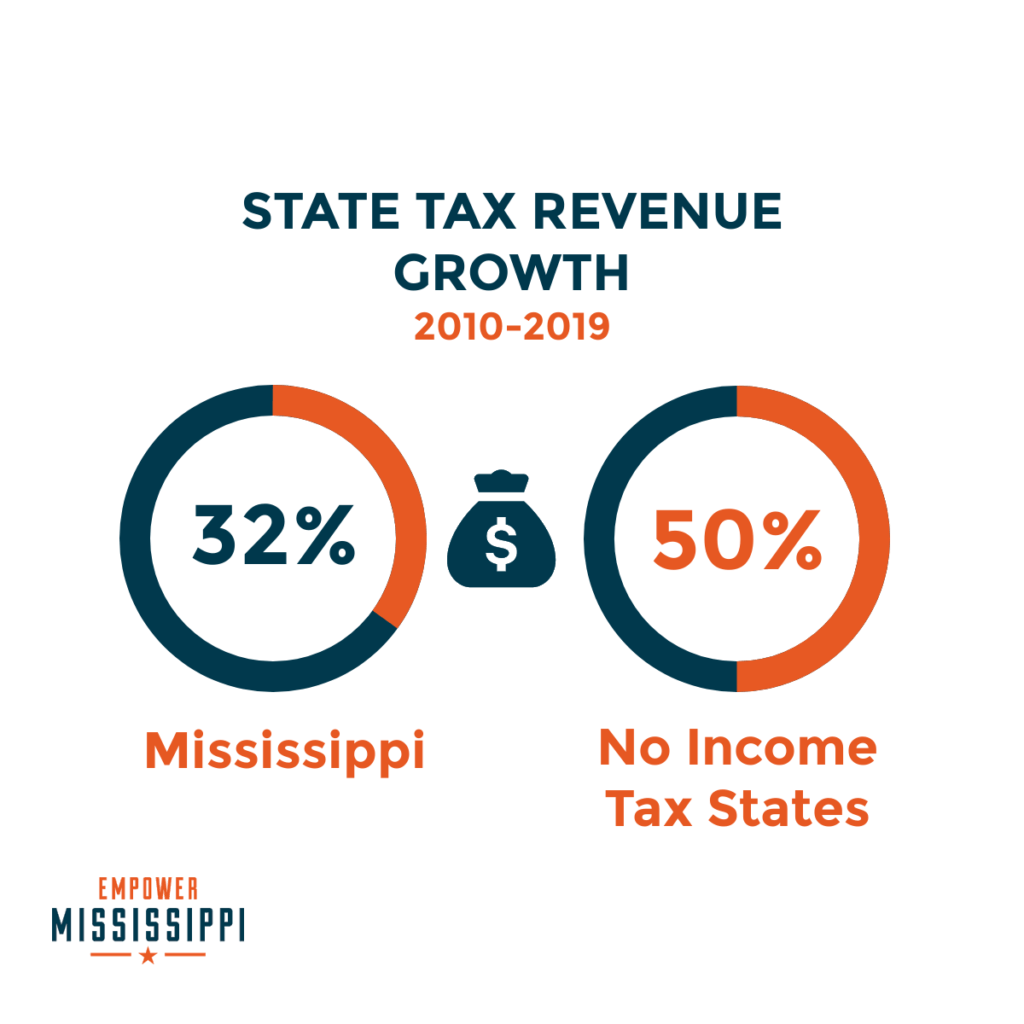

But How Will We Fund Government Without Income Taxes

State Individual Income Tax Rates And Brackets Tax Foundation

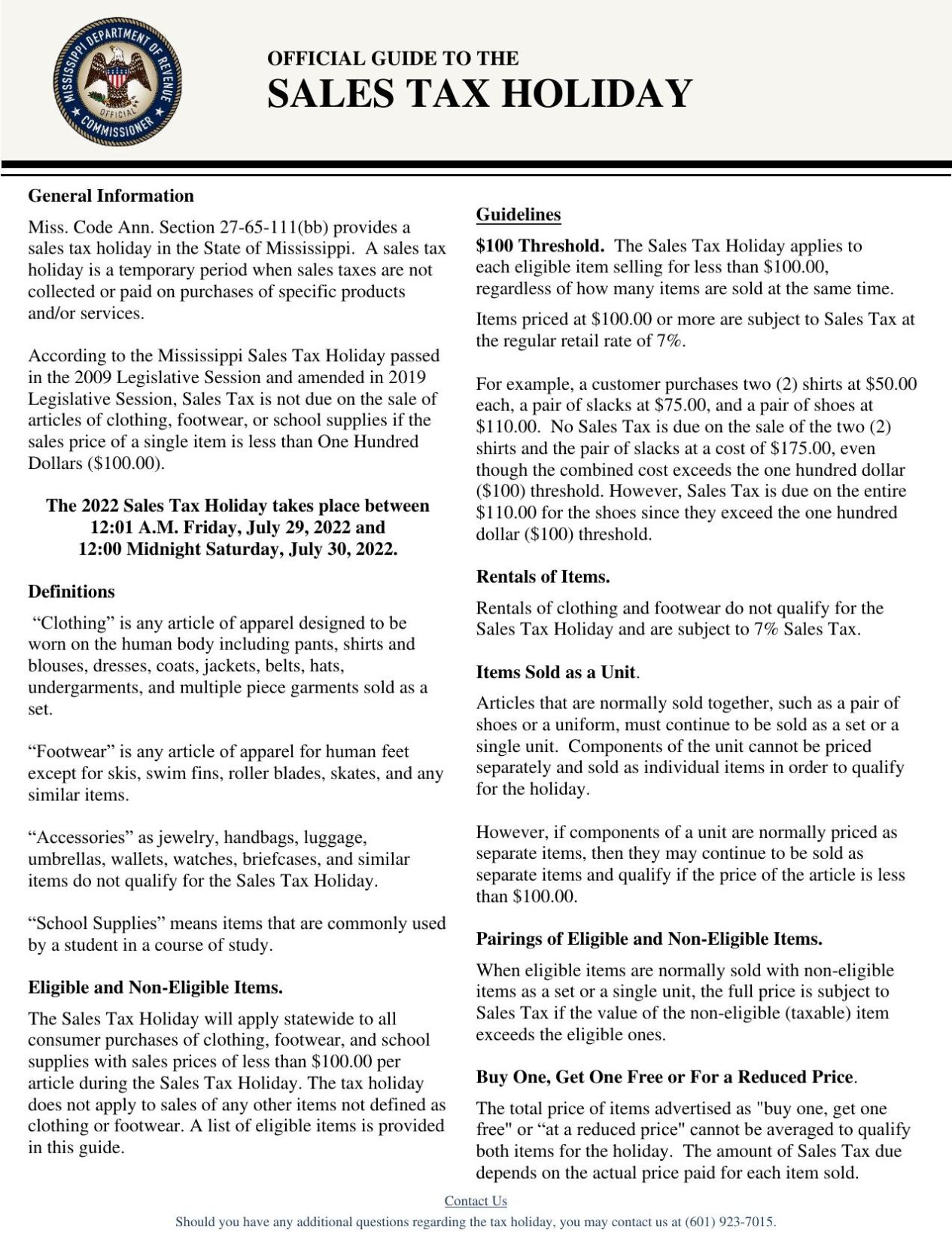

Your Guide To Mississippi S Tax Free Weekend 2022

Sales Tax Holiday Begins Friday In Mississippi News Wtva Com

Ar Ms Tn Sales Tax Holidays What You Need To Know Localmemphis Com

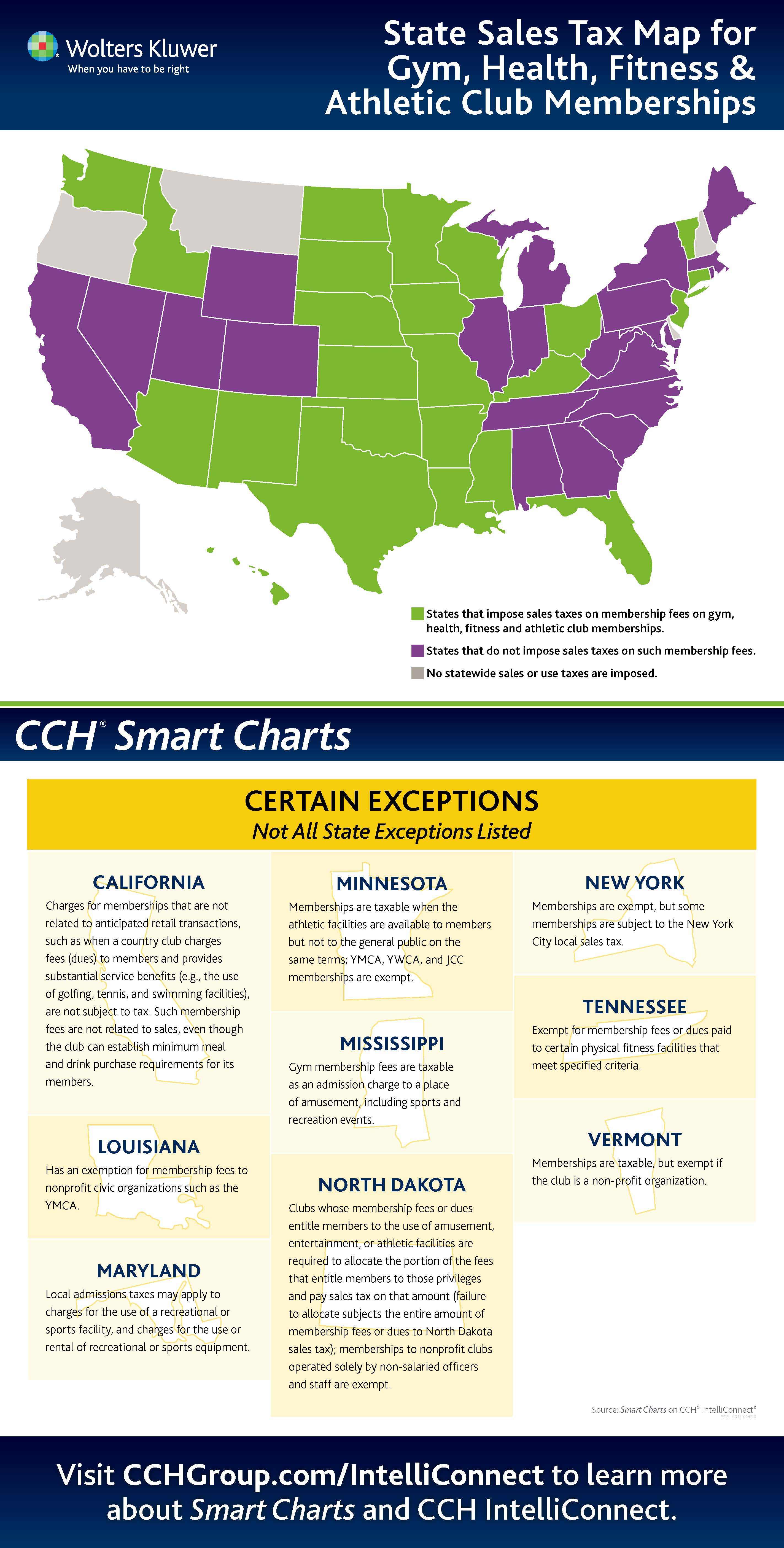

Media Alert Working Out At The Gym Really Can Be Taxing Depending On Where You Live Business Wire

Mississippi Governor Raise Teacher Pay Cut Taxes Localmemphis Com

Mississippi Tax Rate H R Block

Mississippi Property Tax Increases

Sales Taxes In The United States Wikipedia

Prepare Your 2021 2022 Mississippi State Taxes Online Now

Where S My State Refund Track Your Refund In Every State

Every State With A Progressive Tax Also Taxes Retirement Income

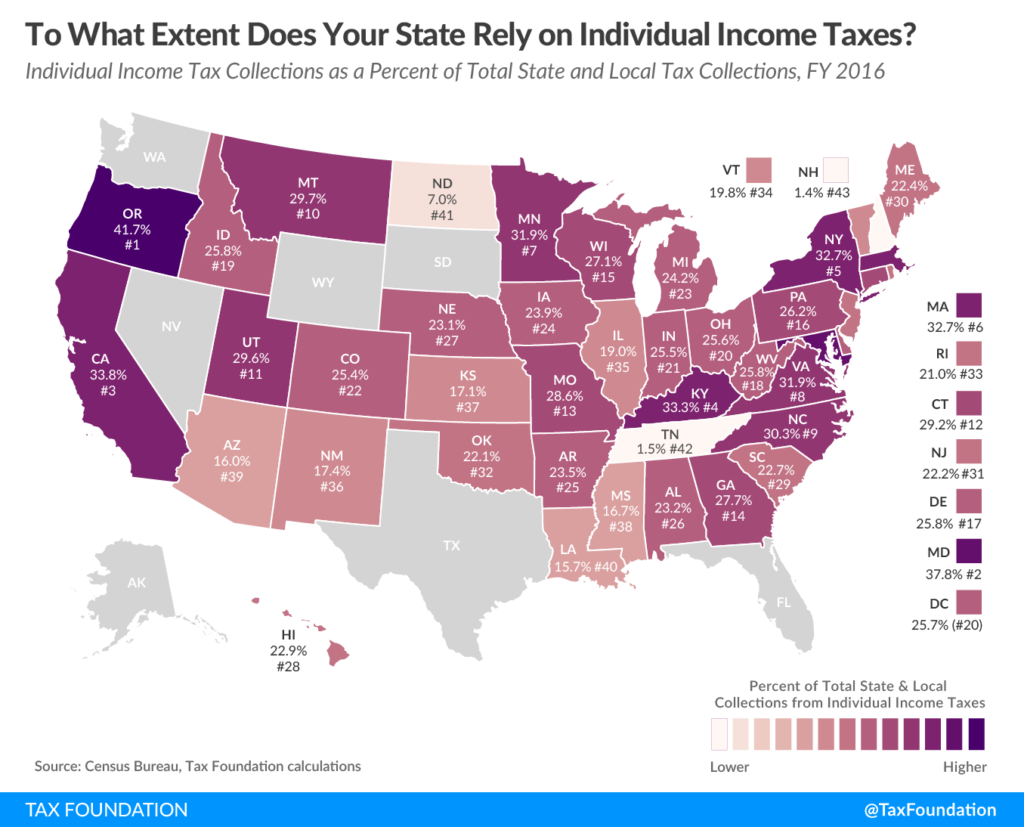

A Look At Mississippi S Reliance On Individual Income Taxes Mississippi Center For Public Policy

Mississippi State Income Tax Ms Tax Calculator Community Tax

:max_bytes(150000):strip_icc()/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png)